Moreover, eligibility criteria may range considerably among lenders.

Moreover, eligibility criteria may range considerably among lenders. Some institutions would possibly impose restrictions primarily based on credit scores or other monetary metrics, making it important for debtors to buy around to search out the best fit for his or her wants. Furthermore, without the in depth background checks widespread in traditional loans, some borrowers might discover themselves facing higher scrutiny after mortgage appro

How to Choose the Right Provider

When looking for a daily mortgage, deciding on the right supplier is crucial to ensure favorable phrases. Start by researching numerous lenders, comparing interest rates and reimbursement situations. Utilize online resources and reviews to gauge lender popularity and buyer experiences. A reliable lender ought to provide clear info relating to the loan phrases and be clear about any charges concer

It's important to remember that this type of loan just isn't appropriate for everybody. Those with secure employment and wonderful credit might discover better charges and phrases with standard financing choices. Weighing all choices available is important earlier than committing to any specific type of l

Additionally, no-document loans usually have flexible tips, which may make them accessible to a broader vary of individuals. Self-employed individuals, for instance, could wrestle with standard loan functions as a end result of inconsistent income or lack of conventional proof of earnings. No-document loans bypass these hurdles, allowing extra individuals the prospect to secure necessary financ

Additionally, evaluations from different borrowers can supply real-world insights into how different lenders function. This group feedback can help you establish lenders with a status for clear practices and truthful te

Despite the upper prices associated with low-credit loans, they could be a stepping stone towards rebuilding credit score. By making well timed payments, debtors can steadily improve their credit score scores, paving the way for better financing choices sooner or later %anchor_te

Another error is underestimating the total costs involved in securing a loan. Borrowers often focus solely on the principal and curiosity however overlook additional prices similar to closing charges, insurance, and property ta

Moreover, if debtors rely on day by day loans frequently, they might find themselves trapped in a cycle of debt. This state of affairs occurs when individuals take out new loans to repay existing loans, resulting in a compounding effect of debt. Therefore, it’s essential to have a realistic assessment of one’s monetary state of affairs and to avoid borrowing beyond one’s me

n To discover a reliable lender for no-document loans, contemplate researching on-line critiques, comparing phrases and interest rates from a number of lenders, and checking their licensing and regulatory compliance. Additionally, platforms like BePick can present valuable insights and person reviews, aiding in selecting respected lend

Lastly, studying evaluations and testimonials from previous customers can shed gentle on the lender’s reputation and customer service. A well-reviewed lender could make the borrowing process smoother and extra transpar

Exploring Be Pick for Your Daily Loan Needs

For anybody looking to delve deeper into the world of daily loans, Be Pick serves as a useful useful resource. This web site makes a speciality of providing detailed insights about numerous

Car Loan products, including complete evaluations and scores from precise users. By exploring Be Pick, borrowers can gain a clear understanding of their options, consider different mortgage providers, and make knowledgeable choices tailor-made to their distinctive monetary situati

Potential Risks Involved

While day by day loans can present quick financial help, they arrive with inherent dangers. The most vital concern is the high interest rates associated with these loans. Since day by day loans are meant to be short-term solutions, lenders typically cost steep fees and interest, which might lead to borrowers owing considerably greater than the original loan quantity. Failure to repay on time can also lead to additionalfees and negatively impression your credit score rat

Lastly, consider looking for help from nonprofit organizations that specialize in monetary counseling and lending. These groups can provide steerage and access to programs designed particularly for folks fighting credit score poi

Before committing, it's wise to have a plan in place for a way you'll repay the

Loan for Credit Card Holders. Consider your work schedule, potential extra time, and other earnings sources. If you have irregular revenue, budgeting might be crucial to guarantee you can meet your obligati

What are Day Laborer Loans? Day Laborer Loans are financial merchandise designed for people who earn their revenue through temporary or irregular work. These loans usually provide fast entry to funds that can assist cover residing bills, emergency prices, or new work-related instruments. Due to the fluctuating nature of day labor work, traditional borrowing options may be inaccessible or unfavorable. Day Laborer Loans provide a viable various, permitting employees to safe financing with out undergoing the prolonged processes typical of ordinary lo

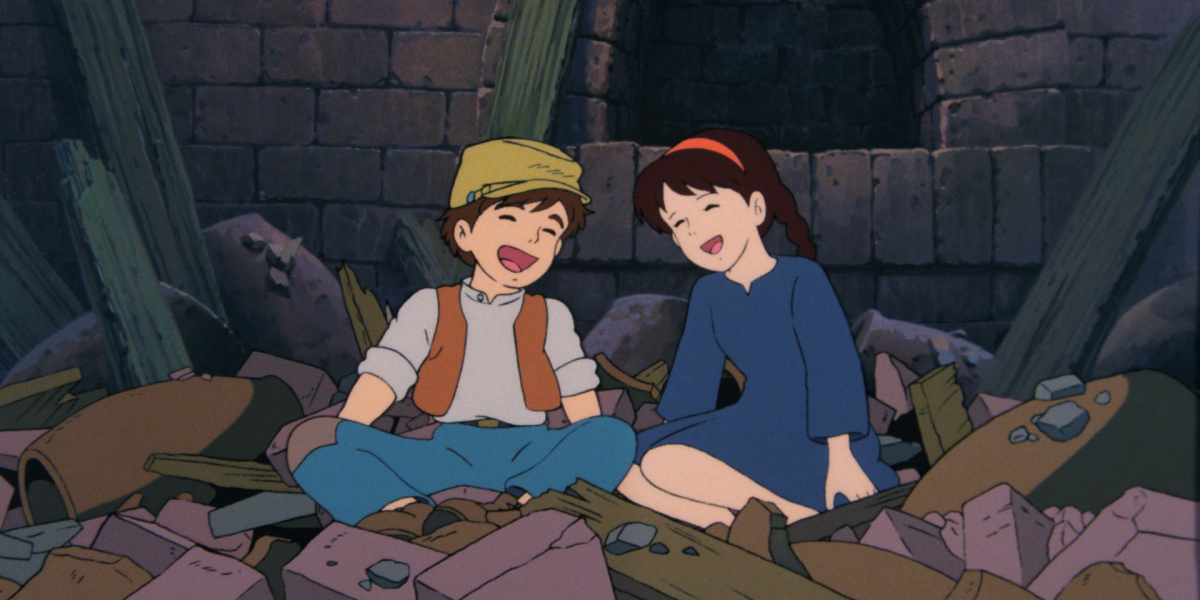

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

Förbi xtameem

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

Förbi xtameem Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

Förbi adultshopsnearme0101

Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

Förbi adultshopsnearme0101 Beykoz Su Kaçak Tespiti

Förbi ustaelektrikci

Beykoz Su Kaçak Tespiti

Förbi ustaelektrikci The 10 Scariest Things About Senior Mobility Scooters

Förbi mymobilityscooters9557

The 10 Scariest Things About Senior Mobility Scooters

Förbi mymobilityscooters9557 Диплом с занесением в реестр цена.

Förbi sergio56u20146

Диплом с занесением в реестр цена.

Förbi sergio56u20146