Understanding Online Cash Flow Loans

Online money flow loans are particularly designed to offer quick funding to companies experiencing short-term money move deficiencies.

Understanding Online Cash Flow Loans

Online money flow loans are particularly designed to offer quick funding to companies experiencing short-term money move deficiencies. Unlike conventional bank loans, which regularly require intensive documentation and prolonged approval instances, on-line cash flow loans offer a streamlined process. This means enterprise owners can acquire funds in as little as 24 hours, serving to them cowl operational costs, payroll, and sudden expen

Moreover, the user-friendly interface ensures that accessing related data is simple and efficient. Whether it's reading testimonials or exploring detailed guides on mortgage choices, 베픽 equips companies with the tools wanted for informed decision-making in the realm of money flow administrat

Additionally, some lenders provide flexible repayment terms tailored to the borrower’s monetary scenario, potentially permitting people to determine on a reimbursement plan that most carefully fits their budget. This flexibility can even present added peace of thoughts, making the compensation course of more manageable and less stress

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms permit individuals to borrow cash directly from other individuals, bypassing traditional banks. These platforms connect borrowers in search of fast loans with buyers keen to lend, typically at competitive rates of interest. This can be a beautiful possibility for borrowers who could not qualify for traditional lo

Additionally, varied duties can be accomplished by way of totally different platforms, corresponding to canine walking, house sitting, or meals delivery, offering a good broader vary of income-generating choices. While this strategy may require some preliminary effort to set up profiles or join with clients, the potential for immediate income could make it worthwh

Leveraging Community Resources

When quick monetary help is necessary, reaching out to neighborhood resources is usually a viable option. Numerous native organizations, charities, and nonprofit companies provide help for people facing emergencies. These resources typically offer grants, food assistance, and utility help, alleviating some monetary burd

Many gig employees juggle a quantity of jobs, which might affect their creditworthiness from a lender's perspective. Freelancers, rideshare drivers, and delivery personnel often have fluctuating incomes that complicate their ability to secure loans. This variability can lead to missed alternatives not just for personal financial administration, but also for professional progr

Choosing the right lender includes evaluating several factors: rates of interest, mortgage terms, customer support evaluations, and the lender's status. It is essential to read buyer critiques and make certain that the lender has clear phrases to keep away from hidden fees and unfavorable conditi

To keep away from pointless fees, debtors ought to make it a priority to create a compensation plan and stick with it. Being proactive about cost dates and amounts can significantly mitigate the chance of overspending and subsequent debt accumulat

Many on-line lenders additionally focus on financial training, offering resources tailor-made to gig employees. For occasion, they offer instruments to match loans, calculate compensation options, and even evaluate total monetary well being. This nuanced understanding can empower gig staff to make informed decisi

Before taking out a personal mortgage, it is important to contemplate the phrases rigorously. Factors like compensation length, monthly payment amounts, and whole interest ought to all be evaluated. Furthermore, it’s advisable to examine one’s credit score score since it will influence the interest rate offered by lenders. A higher credit score score often translates to lower interest rates, saving debtors cash in the long t

One of the primary advantages of short-term on-line loans is their speed. Many lenders supply immediate approval and fast funding, which may be incredibly helpful during financial emergencies. For occasion, an individual going through an surprising medical bill or car repair can secure funds nearly immediately, allowing them to deal with pressing wants direc

While the method can be simple, borrowers ought to be conscious of rates of interest and

이지론 phrases hooked up to these loans. Typically, quick approval loans can have greater interest rates than conventional bank loans because of the elevated danger for lenders. It’s essential for debtors to evaluate their choices and perceive the trade-offs concerned when looking for quick financial assista

To improve your probabilities of personal

Loan for Bankruptcy or Insolvency approval, maintain a good credit score rating by paying payments on time and managing debt responsibly. Additionally, collect essential documentation similar to earnings statements, identification, and another pertinent financial info. Also, compare lenders to search out these with more lenient standards or versatile phra

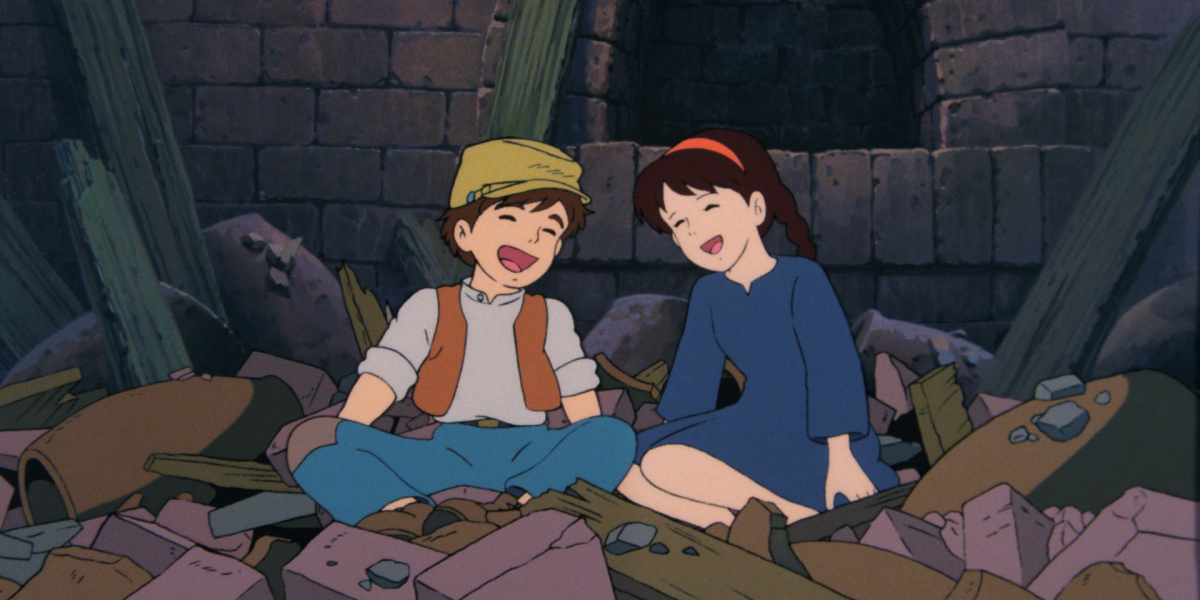

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

Durch xtameem

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

Durch xtameem Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

Durch adultshopsnearme0101

Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

Durch adultshopsnearme0101 Beykoz Su Kaçak Tespiti

Durch ustaelektrikci

Beykoz Su Kaçak Tespiti

Durch ustaelektrikci The 10 Scariest Things About Senior Mobility Scooters

Durch mymobilityscooters9557

The 10 Scariest Things About Senior Mobility Scooters

Durch mymobilityscooters9557 Диплом с занесением в реестр цена.

Durch sergio56u20146

Диплом с занесением в реестр цена.

Durch sergio56u20146