Benefits of 24-Hour Loans

The instant attraction of 24-hour loans lies in their capacity to supply fast entry to funds.

Benefits of 24-Hour Loans

The instant attraction of 24-hour loans lies in their capacity to supply fast entry to funds. This can be

No Document Loan significantly useful in emergencies where time is of the essence. For instance, having quick cash can mean the distinction between getting a needed car repair done at present versus ready for weeks, resulting in bigger inconvenien

Furthermore, borrowers may discover themselves trapped in a state of affairs where they can not repay the loan on time, leading to extra charges and prolonged debt. It is crucial to have a transparent repayment plan and to contemplate whether or not a 24-hour loan is genuinely the best No Document Loan monetary option in the given circumstan

Seeking professional advice, similar to from a financial counselor, can guide your subsequent steps effectively. These professionals can provide tailor-made methods designed to cut back debt and enhance your monetary scenario. A contemporary perspective can usually uncover solutions that may not have been previously thought

Consequences of Delinquent Loans

The consequences of having a delinquent loan could be in depth. For borrowers, the quick concern is usually the impact on their credit score. A credit score rating serves as an indicator of a borrower’s creditworthiness, influencing future lending alternatives. A missed payment or a few delays can lead to a drop in the rating, making it difficult to acquire loans in the fut

Exploring 베픽: Your Business Loan Resource

For anyone navigating the advanced world of enterprise loans, 베픽 is a useful resource. The platform provides comprehensive information on varied financing options, alongside detailed critiques and comparisons that can aid in decision-making. Whether you’re a startup or a longtime enterprise, accessing skilled insights can considerably enhance your technique for securing a l

Additionally, every day loans typically have versatile eligibility standards. This inclusivity means that even these with less-than-perfect credit histories have a better likelihood of acquiring approval. For many, this could open up alternatives that conventional loans would in any other case d

Moreover, the applying course of is usually easy, usually conducted completely online. Many lenders provide prompt decision-making, enhancing the speed at which debtors can access funds. This convenience is very beneficial for individuals who want monetary assistance however might not have the time for prolonged mortgage purpo

Many lenders also assess the nature of your small business and business. Certain sectors are deemed greater risk, which could affect your eligibility or the terms of the loan. Being well-prepared along with your monetary paperwork and a transparent business plan can significantly improve your probabilities of appro

For individuals navigating the world of credit loans, BePick serves as a useful useful resource. The platform provides comprehensive critiques and detailed information about numerous credit loan options available in the market. Users can discover insights on particular lenders, helping them make informed decisions based mostly on their distinctive financial situati

The Role of 베픽 in Daily

Loan for Office Workers Research

As debtors discover daily mortgage options, platforms like 베픽 become invaluable assets. 베픽 provides detailed information, reviews, and comparative analyses of assorted mortgage merchandise. The web site options expert insights that can help individuals in understanding the nuances of every day loans, serving to them make knowledgeable decisi

n Avoiding a debt cycle with 24-hour loans can be achieved by creating a strict price range for repayments and making certain you perceive the loan terms earlier than making use of. Consider alternatives for urgent cash wants and talk overtly with lenders when you foresee points in meeting cost deadli

The website aims to empower users with knowledge, permitting them to make well-informed monetary selections. By critically evaluating the providers offered by different lenders by way of BePick, borrowers can scale back the dangers associated with 24-hour loans. The insights provided can lead to better monetary outcomes and help people find suitable lending options tailor-made to their circumstan

Another consideration is reaching out to native packages that provide financial assistance for particular needs, corresponding to medical payments or housing bills. Community assets may offer short-term assist without the associated risks of debt that come from high-interest lo

In right now's dynamic monetary landscape, securing funding via a enterprise mortgage has become important for a lot of entrepreneurs and small enterprise owners. Whether you're trying to broaden operations, manage working capital, or put cash into new projects, understanding the nuances of enterprise loans is essential. This article aims to break down the elemental features of enterprise loans, discover various varieties, and highlight how providers like 베픽 can help you in this journey. With complete information and knowledgeable evaluations, 베픽 is your one-stop vacation spot for exploring the myriad choices available within the realm of business fina

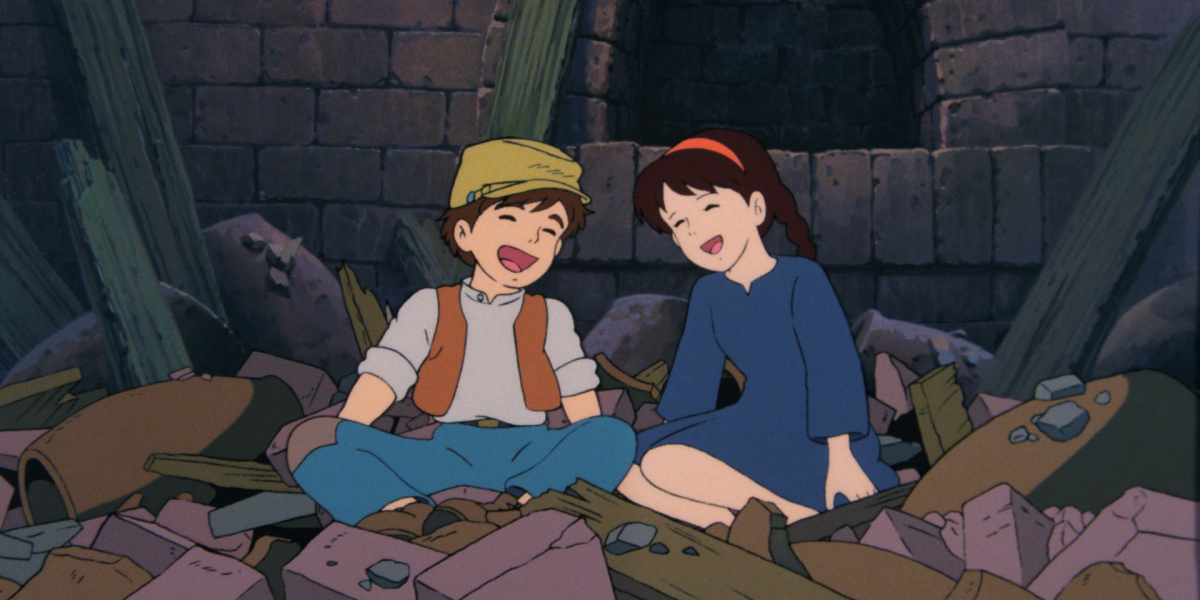

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

کی طرف سے xtameem

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

کی طرف سے xtameem Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

کی طرف سے adultshopsnearme0101

Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

کی طرف سے adultshopsnearme0101 Beykoz Su Kaçak Tespiti

کی طرف سے ustaelektrikci

Beykoz Su Kaçak Tespiti

کی طرف سے ustaelektrikci The 10 Scariest Things About Senior Mobility Scooters

کی طرف سے mymobilityscooters9557

The 10 Scariest Things About Senior Mobility Scooters

کی طرف سے mymobilityscooters9557 Диплом с занесением в реестр цена.

کی طرف سے sergio56u20146

Диплом с занесением в реестр цена.

کی طرف سے sergio56u20146