In recent years, the monetary panorama in South Carolina has witnessed a big rise in the recognition of no credit check loans. These loans, typically marketed as quick and straightforward options for individuals facing monetary difficulties, have develop into a topic of dialogue amongst shoppers, monetary consultants, and policymakers. This observational analysis article goals to delve into the traits, implications, and client behaviors surrounding no credit check loans in South Carolina.

Understanding No Credit Check Loans

No credit check loans are monetary products that enable borrowers to secure funds without the normal credit evaluation that most lenders require. Instead of evaluating a borrower’s credit score historical past, lenders typically concentrate on other components equivalent to income, employment standing, and bank account info. These loans are sometimes offered by payday lenders, on-line lenders, and some credit unions, and they come in various types, together with payday loans, installment loans, and title loans.

The Attraction of No Credit Check Loans

The first allure of no credit check loans lies of their accessibility. Many people in South Carolina might have poor credit score scores due to numerous reasons, including medical debt, unemployment, or past monetary mismanagement. For these customers, typical loans will be unattainable, making no credit check loans a horny various. These loans are marketed as a fast repair for pressing financial wants, such as unexpected medical bills, automobile repairs, or utility bills.

Demographic Insights

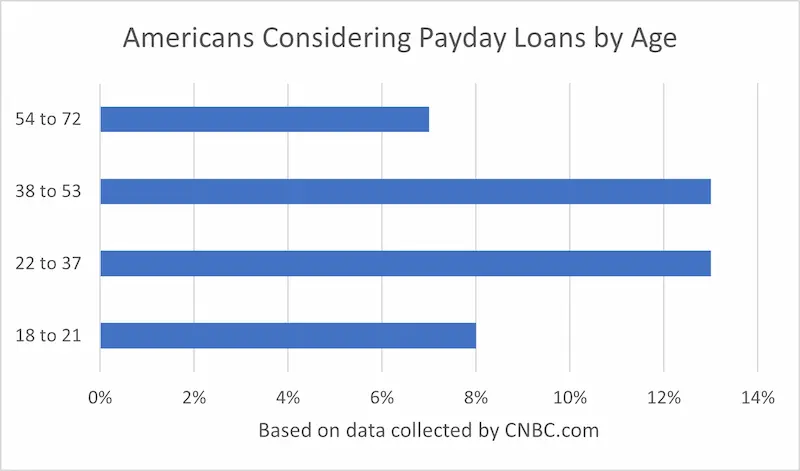

Observational knowledge signifies that a big portion of borrowers utilizing no credit check loans in South Carolina belong to decrease-earnings households. Many of these individuals work in sectors with irregular revenue, akin to retail or service industries, which can make it challenging to fulfill traditional loan necessities. Additionally, the demographic profile of borrowers usually consists of youthful adults, notably these aged 18 to 34, who may lack established credit histories.

The Borrowing Course of

The means of obtaining a no credit check loan is usually straightforward and expedited. Borrowers can typically complete purposes online registration loans no credit check or in-particular person, with minimal documentation required. This ease of entry can lead to impulsive borrowing, where individuals could take out loans without totally understanding the terms or the potential penalties. Observations reveal that many borrowers do not learn the fantastic print, resulting in misunderstandings relating to interest charges, repayment durations, and fees.

Curiosity Rates and Fees

Some of the concerning aspects of no credit check loans is the excessive-curiosity charges and fees associated with them. In South Carolina, payday loans, for instance, can carry annual proportion rates (APRs) exceeding 400%. Such exorbitant rates can lure borrowers in a cycle of debt, where they are pressured to take out further loans to repay previous ones. Observational studies highlight that many borrowers in South Carolina find themselves rolling over loans, incurring further charges, and finally going through monetary distress.

Client Behavior and Attitudes

Interviews conducted with borrowers reveal a posh relationship with no credit check loans. While many categorical gratitude for the rapid financial relief these loans present, there can also be a sense of remorse concerning the long-time period implications. Some borrowers report feeling overwhelmed by the repayment course of, leading to increased stress and anxiety. Moreover, an absence of monetary literacy performs a big role in shopper behavior, as many people don't totally perceive the results of high-curiosity borrowing.

The Regulatory Landscape

The regulatory atmosphere surrounding no credit check loans in South Carolina has been a point of contention amongst consumer advocates and lawmakers. If you cherished this article and also you would like to get more info with regards to quick and easy payday loans no credit check (Jobs.askpyramid.com) generously visit the web page. Whereas some laws exist to guard borrowers, similar to limits on loan quantities and repayment phrases, critics argue that these measures are inadequate. Observational research indicates that many borrowers are unaware of their rights and protections, leaving them vulnerable to predatory lending practices. Advocacy groups are pushing for stricter regulations to ensure truthful lending practices and to advertise financial education amongst consumers.

Options to No Credit Check Loans

In light of the challenges associated with no credit check loans, it is important to explore various financial products that may better serve consumers in South Carolina. Options akin to credit score unions, neighborhood growth financial institutions (CDFIs), and peer-to-peer lending platforms offer more favorable phrases and decrease curiosity rates. Moreover, monetary schooling packages can empower people to make informed choices and explore budgeting strategies to avoid reliance on high-cost loans.

Conclusion

No credit check loans present a double-edged sword for shoppers in South Carolina. Whereas they supply instant access to funds for those in want, the lengthy-time period monetary implications might be detrimental. Observational analysis highlights the significance of understanding the borrowing course of, the associated prices, and the necessity for regulatory reforms to guard vulnerable customers. Because the demand for these loans continues to rise, it is crucial for policymakers, monetary educators, and neighborhood organizations to work collaboratively to advertise responsible lending practices and to provide consumers with the tools they need to make informed financial decisions. By addressing the basis causes of monetary insecurity and increasing access to affordable credit options, South Carolina can foster a healthier financial ecosystem for all its residents.