In immediately's monetary landscape, many buyers are seeking ways to diversify their portfolios and protect their wealth from market volatility. One more and more widespread option is a top-rated gold ira firms IRA, which allows people to carry physical gold and other precious metals inside their retirement accounts. This text will guide you through the process of buying a Gold IRA, its benefits, and issues to keep in mind.

What is a Gold IRA?

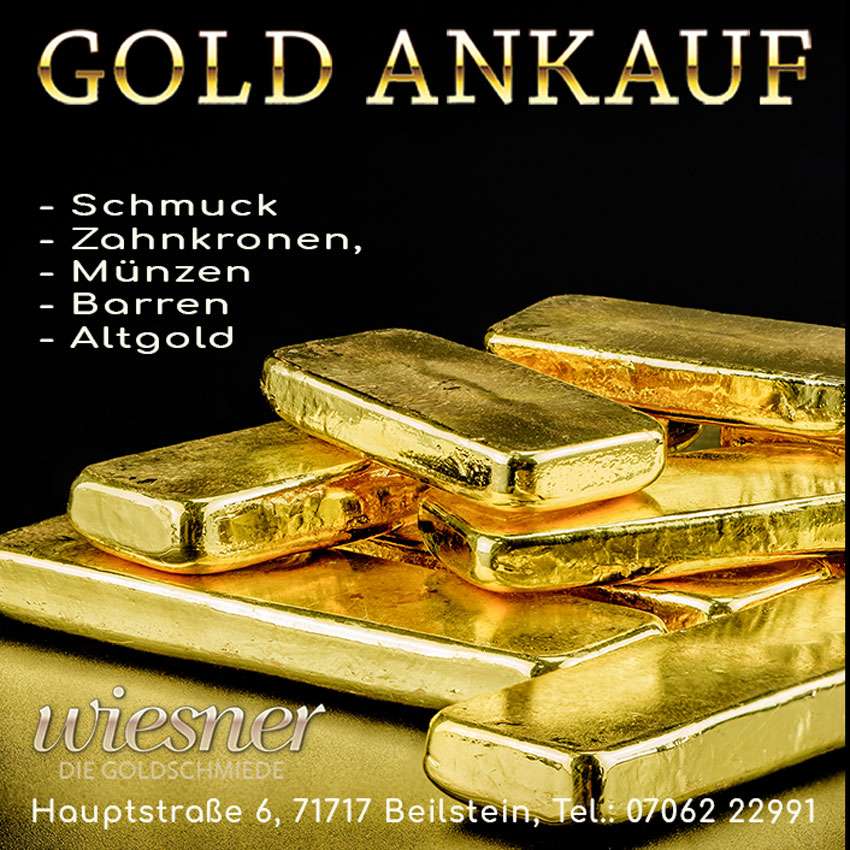

A Gold IRA (Particular person Retirement Account) is a self-directed retirement account that lets you invest in bodily gold and different authorised treasured metals. Not like traditional IRAs, which usually hold stocks, bonds, and mutual funds, a Gold IRA offers you the chance to own tangible assets. The IRS permits sure kinds of valuable metals, including gold, silver, platinum, and palladium, to be included in these accounts.

Advantages of a Gold IRA

- Inflation Hedge: Gold has historically been considered as a hedge against inflation. When the value of forex decreases, gold typically retains its value, making it a safer investment throughout economic downturns.

- Diversification: Together with gold in your investment portfolio can assist diversify your assets. This could cut back overall threat, as gold typically strikes independently of stocks and bonds.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that you can hold. This can present a sense of security reliable companies for retirement precious metals many investors.

- Tax Advantages: A Gold IRA gives the same tax benefits as traditional IRAs. You'll be able to defer taxes on positive aspects until you withdraw funds throughout retirement, and it's possible you'll even be eligible for tax deductions on contributions.

- Safety In opposition to Foreign money Devaluation: In instances of economic instability or forex devaluation, gold tends to take care of its value, serving as a dependable store of wealth.

How to purchase a Gold IRA

- Select a Custodian: Step one in shopping reliable options for ira gold rollover a Gold IRA is to select a custodian. A custodian is a monetary institution that manages your retirement account and ensures compliance with IRS laws. Look recommended companies for gold ira rollover a custodian that focuses on precious metals and has an excellent status.

- Open an Account: After getting chosen a custodian, you might want to open a self-directed IRA account. This process usually entails filling out an application and providing identification and monetary info.

- Fund Your Account: You'll be able to fund your Gold IRA through various strategies, including transferring funds from an present retirement account (resembling a 401(k) or conventional IRA) or making a direct contribution. Bear in mind of contribution limits and tax implications.

- Select Your Precious Metals: After funding your account, you possibly can choose the varieties of precious metals you wish to put money into. The IRS has particular requirements for the forms of gold that can be held in a Gold IRA, together with:

- Gold bars (with a minimum purity of 99.5%)

Be sure that the metals you select meet IRS requirements to keep away from penalties.

- Buy and Retailer Your Gold: Upon getting selected your metals, your custodian will facilitate the purchase. It's crucial to have your gold saved in an IRS-authorized depository to ensure compliance with rules. You can not retailer the gold your self.

- Monitor Your Funding: After your Gold IRA is established and funded, it is essential to observe your investment commonly. Keep watch over market developments, gold costs, and your total investment strategy.

Considerations When Investing in a Gold IRA

- Fees: Bear in mind of the charges associated with a Gold IRA, together with setup charges, storage charges, and transaction fees. These can vary considerably between custodians, so it's vital to compare prices.

- Market Volatility: While gold is often seen as a stable funding, its price can nonetheless be unstable in the brief time period. Be prepared for fluctuations and consider your funding horizon.

- Liquidity: Selling gold might be more difficult than selling stocks or bonds. If you enjoyed this write-up and you would like to receive additional information pertaining to best companies for retirement ira investments kindly go to the web-site. It might take time to discover a purchaser, and you could face additional charges when liquidating your investment.

- IRS Regulations: Guarantee that you perceive IRS laws concerning Gold IRAs. Failure to comply can result in penalties and taxes.

- Lengthy-Time period Perspective: Investing in a Gold IRA should be considered as a long-time period strategy. It isn't sometimes a quick approach to earn cash but fairly a means to preserve wealth over time.

Conclusion

A Gold IRA is usually a useful addition to your retirement portfolio, providing diversification, safety towards inflation, and the benefits of tangible assets. However, it is crucial to conduct thorough research and perceive the associated costs and laws earlier than making any funding selections. By following the steps outlined on this guide, you'll be able to navigate the process of shopping for a Gold IRA and potentially secure your monetary future with the stability that gold can supply. All the time consult with a monetary advisor to ensure that your investment technique aligns along with your long-term financial targets.