Potential Risks and Considerations

While small loans can present quick monetary help, there are inherent dangers involved.

Potential Risks and Considerations

While small loans can present quick monetary help, there are inherent dangers involved. One main concern is the rates of interest, which could be significantly higher than conventional loans, significantly with payday loans. Borrowers must be certain that they will meet the reimbursement phrases to avoid falling right into a cycle of d

Understanding Same-Day Loans Same-day loans are short-term monetary merchandise designed to provide borrowers with quick access to money. Typically, these loans can be processed and approved on the same day, making them a reliable choice for pressing financial wants. They usually include high-interest rates, however the benefit of instant funding typically outweighs the prices for so much of debt

Additionally, some believe that every one no-visit loans carry exorbitant interest rates. While comparing loan provides is essential, debtors can discover competitive rates which are on par with traditional loans by using trustworthy lenders. Vigilant analysis is vital to overcoming these misconcepti

Additionally, small loans are characterized by their speedy approval occasions. Borrowers can usually obtain funds within a day, addressing pressing financial wants swiftly. This side is especially useful for emergencies where fast money is paramo

BePick not solely options skilled analysis but in addition provides user-generated reviews, making a reliable space where potential patrons can share their experiences and insights. This variety of information permits guests to weigh professionals and cons effectively and select what fits their wants great

What is a Small Loan?

A small loan generally refers to any mortgage amount that's under a certain threshold, often ranging between $500 to $5,000. These loans can are available in varied forms, including personal loans, payday loans, or microloans. The primary appeal of small loans lies of their accessibility and pace, with many lenders offering fast approval and disbursement processes. Armed with higher understanding, potential borrowers can consider their choices and identify what fits their monetary wants fin

Checking Your Budget

Before committing to an auto mortgage, it’s essential to assess your price range. This consists of not only the month-to-month cost but also further prices associated with automotive ownership, such as insurance coverage, maintenance, fuel, and registration fees. Financial experts advocate that your complete month-to-month automotive bills mustn't exceed 15% of your take-home pay. This helps make certain that you keep monetary stability while enjoying your new vehicle. Evaluating your finances upfront might shield you from future monetary pressure or challen

**Peer-to-peer lending** platforms are gaining popularity, allowing individuals to borrow funds directly from different folks rather than monetary establishments. This methodology can often yield decrease interest rates and extra versatile compensation choices, though it requires thorough research earlier than engaging. Each sort of small loan presents its personal set of pros and cons, emphasizing the importance of understanding one’s personal financial scenario earlier than making any commitme

An emergency loan is a kind of monetary assist designed to assist individuals handle unforeseen expenses. These loans are typically unsecured, that means that debtors do not want to supply collateral, which makes them easier to acquire in pressing conditions. Emergency loans can vary from personal loans to payday loans, and their primary objective is to offer quick cash. The terms and circumstances differ significantly based mostly on the lender and

이지론 the borrower's monetary situation, so assessing these elements is crucial before apply

Small loans supply a lifeline for individuals and businesses needing quick financial assistance. These loans, typically with lower amounts and shorter terms, cater to those with limited credit or urgent needs. Understanding the ins and outs of small loans can empower debtors to make informed selections, ensuring they select options that greatest swimsuit their circumstances. For these seeking detailed insights and critiques on small loans, the BePick website serves as an invaluable useful resource that is dedicated to offering comprehensive information tailor-made to guide prospective borrowers successfu

The loan amount, interest rate, and reimbursement term will all affect your month-to-month payments and the entire value of the automobile. Generally, lenders supply a range of phrases, usually from 36 to 72 months. Shorter terms may include higher

Monthly Payment Loan payments however decrease overall interest prices, whereas longer terms may provide extra affordable payments however enhance the total curiosity paid over the lifetime of the mortg

Understanding Auto Loans

Auto loans are a type of secured loan specifically designed for buying a vehicle. When you're taking out an auto mortgage, the vehicle itself acts as collateral. This means that when you fail to repay the mortgage, the lender has the proper to repossess the automotive. Understanding how these loans work is fundamental to making sure that you select the best option for your financial scena

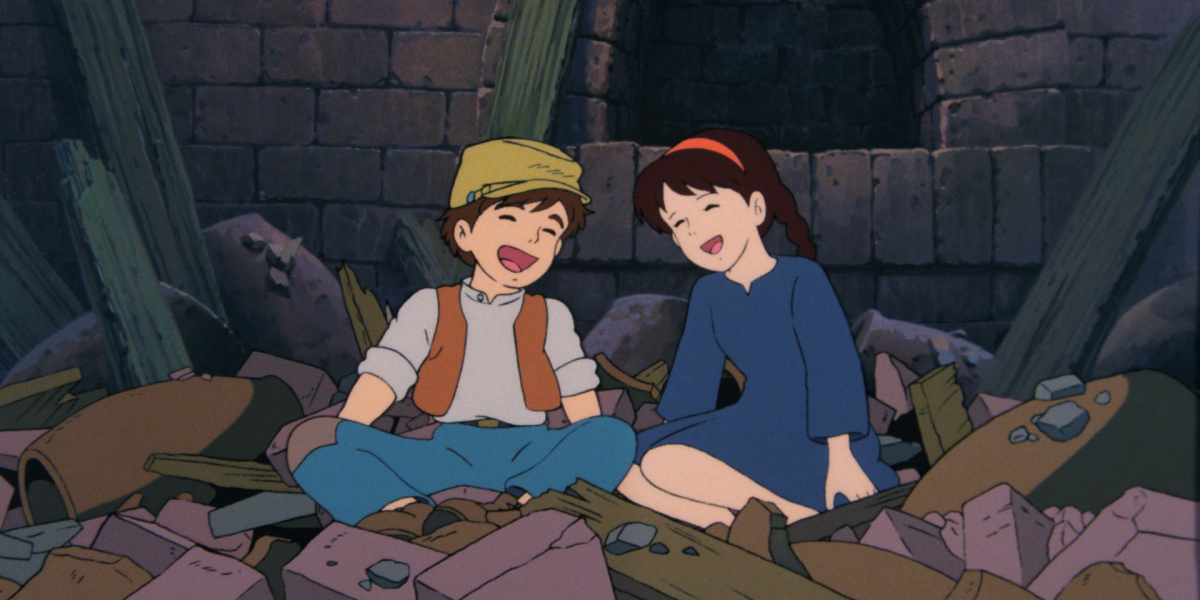

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

بواسطة xtameem

「天空 の 城 ラピュタ」の歌: 名曲の魅力とその背景

بواسطة xtameem Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

بواسطة adultshopsnearme0101

Exploring the World of Adult Anal Toys: Pleasure, Exploration, and Empowerment

بواسطة adultshopsnearme0101 Beykoz Su Kaçak Tespiti

بواسطة ustaelektrikci

Beykoz Su Kaçak Tespiti

بواسطة ustaelektrikci The 10 Scariest Things About Senior Mobility Scooters

بواسطة mymobilityscooters9557

The 10 Scariest Things About Senior Mobility Scooters

بواسطة mymobilityscooters9557 Диплом с занесением в реестр цена.

بواسطة sergio56u20146

Диплом с занесением в реестр цена.

بواسطة sergio56u20146